On May 17th, Sears (SHLD) reported its first-quarter 2012 earnings results and exceeded Wall Street analysts' expectations by delivering a profit in the first-quarter. The company's earnings are as follows:

- Income from continuing operations attributable to Holdings' shareholders for the first quarter of 2012 of $189 million versus a net loss from continuing operations attributable to Holdings' shareholders of $165 million for the first quarter of 2011

- Adjusted EBITDA for the quarter of $197 million in 2012 versus $58 million in 2011

- Adjusted loss per diluted share of $0.31 in 2012 and a loss of $1.34 in 2011

- First quarter 2012 included gains on the sale of assets of $233 million from the sale of certain U.S. and Canadian stores and leasehold interests. These transactions generated approximately $440 million of cash proceeds

- Gross margin rate in 2012 improved 100 basis points over the prior year quarter

- Sears Domestic's comparable store sales declined 1.0% in the first quarter of 2012, Kmart's comparable store sales declined 1.6% and Sears Canada's comparable store sales declined 6.3%

- Currently planning a partial spin-off of our interest in Sears Canada to our shareholders, as announced today in a separate release, which would bring the ownership of SCC by Sears Holdings to 51% when complete

These results show progress, but much of the good news comes on the heels of the company selling assets. This makes the first-quarter 2012 profit say less about the company's ability to maintain operations while remaining profitable and more about the company going through a restructuring effort. SHLD needs to prove that it can carry out its strategic goal to restructure the company in a way that would build a network of profitable stores that can be sustained within a highly competitive market. The results from this effort are too preliminary to grasp a clearer picture of what SHLD's future looks like.

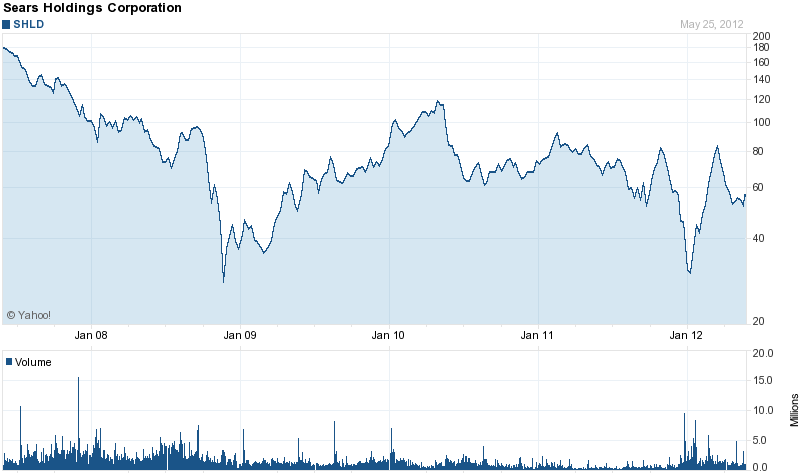

(click to enlarge)

(Yahoo! Finance)

Fundamentals:

Due to SHLD real estate holdings and integral value, the company does have tangible assets that it either sell off or transform into profitable sites. This gives SHLD a means to raise capital and begin to act upon the plan that Lou D'Ambrosio, SHLD CEO & Chairman, put forth:

We are pleased with the results for the first quarter and our progress towards restoring profit growth and transforming our Company. Our actions were driven by a focus on three core priorities: 1) enhancing financial and operational discipline; 2) improving our core retail operations; and 3) leading customer based innovation through integrated retail and an engaging membership program, Shop Your Way Rewards.

The progress on these initiatives is difficult to quantify at this time due to customer perception being a difficult matter to turn around. Retailers like Target (TGT) and Wal-Mart (WMT) have gained positive customer reviews and in doing so have secured much of this market. For a retailer like SHLD to turn around its operations, it must first begin to turn around the perception among consumers that it has lost its way. Thus far, the company has not proven such and until D'Ambrosio's three transformations occur, SHLD is a risky company.

Canadian Spin-Off:

SHLD is planning to reduce its stake in Sears Canada from 95% to 51% in the latter-half of this year. This is in an effort to raise capital in order to invest within its US operations and begin to turn around the ailing retailer. What is still not clear and proven is whether this increase in capital will be accompanied by an increase in productivity. The return on investment (ROI) from past actions by SHLD has not been particularly high and thus the company has much to prove before it can be determined whether or not it can turn around public perceptions.

Conclusion: Until SHLD is able to deliver profitability on the heels of its operations alone, without selling off parts of its business, the company cannot be viewed as being in a true turnaround stage. SHLD needs to deliver on its promise to enhance operational discipline, improve its core operations, and lead customer innovation through an integrated program to drive loyalty once again. It is now time to wait on the sidelines for whether or not SHLD can execute its strategic goals.

(All financial metrics referenced above are obtained from Yahoo Finance, CNBC Analytics, S&P Capital IQ and Thomas Reuters.)

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.